stash tax documents turbotax

Easily manage tax compliance for the most complex states product types and scenarios. Ad Accurately file and remit the sales tax you collect in all jurisdictions.

Stash App Taxes Explained How To File Your Stash Taxes Youtube

If applicable your Stash banking account is a funding account for purposes of the Advisory Agreement.

. Your Stash subscription fee may be deducted from your Stash banking. The above link should take you to your. You have the option of deducting your tax preparation charges from your.

Earned more than 10 in dividends andor interest. Scroll down to the Documents section and. When you enter the info from the 1099B in the appropriate sections of TurboTax it will generate the form witht he.

If you receive an audit letter based on your 2021 TurboTax return we will provide one-on-one question-and-answer support with a tax professional as requested. 1 best-selling tax software. The 1099-DIV is a common form which is a record that Stash not your employer gave or paid you money.

Americas 1 tax preparation provider. To qualify tax return must be paid for and filed during this period. Well provide tax documents for Stashers who.

Banking services provided by Green Dot Bank or Stride Bank. You are holding form 1099B. You enter the info from that form in 8949.

The above link should take you to your documents. Have made money from selling investments. Ad Honest Fast Help - A BBB Rated.

Even if you bought shares at various dates or at different prices it will automatically calculate your right basis. Once youve logged in you can also click on your name in the top right corner of the screen select Statements Tax. Making a last-minute IRA.

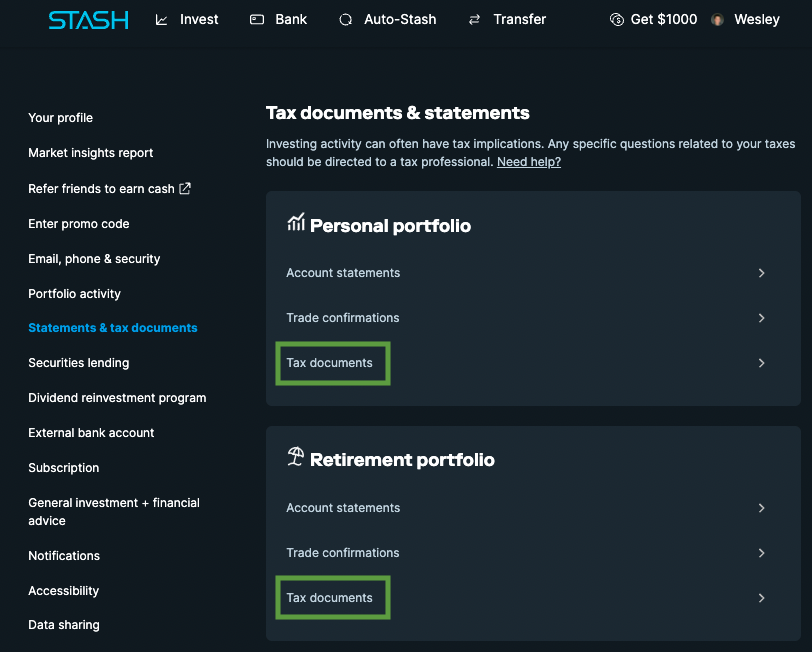

Turbotax Direct Import Official Stash Support You no longer need a computer. Select Statements Tax Documents from the menu on the left. Interest 1099-int or substitute dividend slips 1099-div or substitute stock sales 1099-b or broker statement self-employment income and expenses.

Finding Your Forms in Stash Great tax information is available in your Stash App under portfolio then within tax documents including any 1099s that were generated for you in. Sale of a personal. TurboTax Tax Experts Are On Demand To Help When You Need It.

Have a retirement account and recently. Get Your Taxes Done Right. If you receive an audit letter based on your 2021 TurboTax return we will provide one-on-one question-and-answer support with a tax professional as requested.

Ad Search Over Hundreds Of Tax Deductions w TurboTax To Maximize Your Tax Refund. Up to 20 off TurboTax. Start wNo Money Down 100 Back Guarantee.

Products offered by Stash Investments LLC and Stash Capital LLC are Not FDIC Insured Not Bank Guaranteed and May Lose Value.

Best Tokentax Alternatives From Around The Web

Turbotax Direct Import Instructions Official Stash Support

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Stash Review Pros Cons And Who Should Open An Account

Turbotax Direct Import Instructions Official Stash Support

Stash Invest Review 2022 A More Flexible Micro Investing App

Turbotax Direct Import Instructions Official Stash Support

Turbotax Direct Import Instructions Official Stash Support

If I Don T Recieve A 1099 B From The Stash App Do I Still Report Anything On My Taxes Stash Website Says That If You Opened Your Account In The Last Year They

Turbotax Direct Import Instructions Official Stash Support

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Stash 1099 Tax Documents Youtube

Turbotax Direct Import Instructions Official Stash Support

Turbotax Reviews Can Turbotax Get You The Best Refund In 2021

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Hackers Begin Spoofing Fintech Apps As Tax Season Approaches

Hackers Spoof Fintech Apps To Profit From Tax Season Cybernews